Expert Payroll Outsourcing & Consulting for South African Businesses

Reduce admin by 70% with automated payroll solutions trusted by 14 000+ companies.

Why Businesses Choose ReyPath for Payroll

Support for 40+ Countries

From local SMEs to multinational corporations, we handle complexity so you don’t have to.

Our payroll software supports multiple currencies and jurisdictions with automatic updates for legislative compliance.

Guaranteed Accuracy

Eliminate costly payroll mistakes.

Our team specialises in automated systems, compliance checks & data loss prevention ensuring SARS and PAYE accuracy.

70% Less Admin Time

Stop spending hours on payroll admin.

Our automated processes and integration capabilities free your team to focus on strategic work, not manual data entry.

Our Services

Payroll Outsourcing

Fully managed payroll processing with guaranteed accuracy and on-time delivery. Perfect for businesses wanting to eliminate payroll headaches entirely.

What’s included:

– Monthly payroll processing

– Statutory submissions

– Employee self-service portal

– Dedicated account manager

– 24/7 payroll support

Ideal for: SMEs to large enterprises (10-500+ employees)

Payroll Software Migration

Seamless migration to modern payroll systems with zero disruption. We handle the technical complexity while you maintain business continuity.

What’s included:

– System setup and configuration

– Data migration from legacy systems

– Staff training and documentation

– Go-live support

– Post-implementation review

Ideal for: Companies upgrading payroll systems

Payroll Consulting

Strategic payroll advice to optimise processes, ensure compliance, and reduce costs. Get expert guidance without the full outsourcing commitment.

What’s included:

– Payroll process audits

– Compliance reviews

– System optimisation

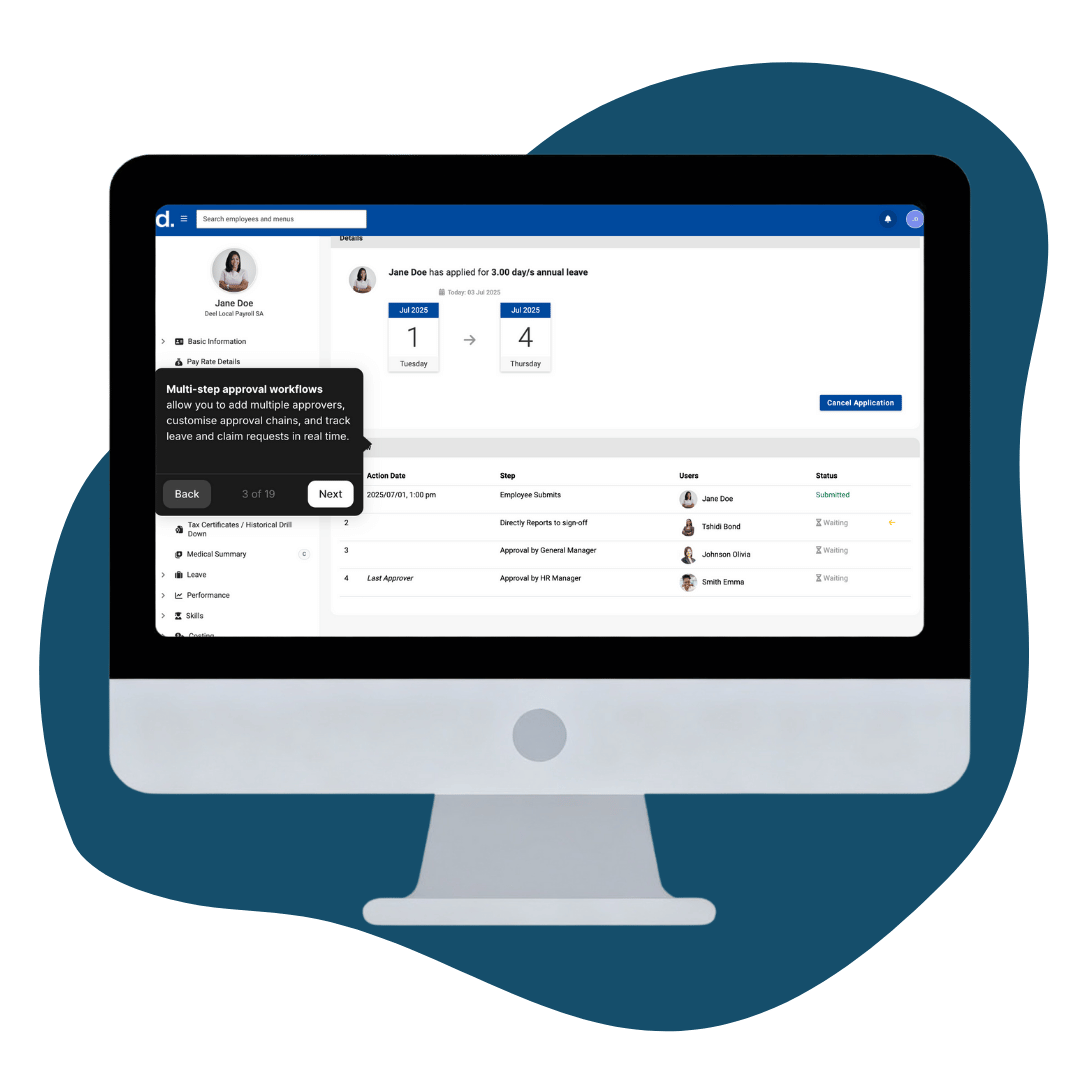

– Custom workflow design

– Ongoing advisory support

Ideal for: Businesses with in-house payroll teams

Employer of Record

Hire and manage employees in South Africa without establishing a legal entity. We become the legal employer while you maintain day-to-day control.

What’s included:

– Legal employment contracts

– Full payroll and tax compliance

– Benefits administration

– HR compliance management

– Local employment law expertise

Ideal for: International companies hiring in South Africa

GET TO KNOW US

Trusted by Leading South African Businesses

Unlike local-only providers, ReyPath offers true multi-country payroll capability, processing payroll across 40+ countries with automated currency conversion and built-in local compliance, while ensuring same-day issue resolution through dedicated account managers who respond within two hours—no call centres, no ticket systems, just direct access to payroll experts who understand your business.

Tax Experts

GDPR & POPIA Compliant

55+ Years Payroll Expertise

100% Client Retention Rate

What Our Clients Say

Frequently Asked Questions About Payroll Outsourcing

What is payroll outsourcing?

Payroll outsourcing means hiring an external specialist company like ReyPath Solutions to handle all aspects of your payroll processing, from calculating salaries to submitting tax returns to SARS. This eliminates the need for in-house payroll staff and systems.

How much does payroll outsourcing cost in South Africa?

Payroll outsourcing typically costs between R50-R180 per employee per month, depending on complexity, company size, and services included. We provide custom quotes based on your specific needs. Request a free quote to see exact pricing for your business.

Is my payroll data secure with ReyPath?

Yes. We use bank-level encryption, daily automated backups, and stringent policies to guide internal processes. We're fully POPIA and GDPR compliant. Your data is more secure with us than on local servers.

How long does payroll implementation take?

Most implementations are complete within 2-12 weeks. This includes data migration, system setup, staff training, and the first payroll run. We handle the technical work while you maintain business continuity.

Can you handle multi-country payroll?

Yes. Our software processes payroll for 40+ countries with automated currency conversion, local tax compliance, and country-specific reporting. Perfect for businesses with international employees.

Do you integrate with our existing accounting software?

Yes. We integrate with major accounting platforms including Sage, Xero, QuickBooks, and Pastel. This eliminates double data entry and ensures your payroll and accounting stay in sync.

Can we switch back to in-house payroll later?

Absolutely. You own your data and can export it anytime. We provide full documentation and transition support if you ever decide to bring payroll in-house, though most clients stay with us long-term.

Ready to Transform Your Payroll?

Join businesses who’ve eliminated payroll stress with ReyPath Solutions.

Get a free payroll audit and custom quote.